Day Rettig Martin, P.C. is proud to continue its tradition of supporting the next generation of agricultural leaders through active participation in the Linn County Fair Youth Livestock Auction. Growing up on a farm himself and having been a member of 4-H and FFA, Attorney Ron Martin understands firsthand the importance of youth programs in promoting skills and values.

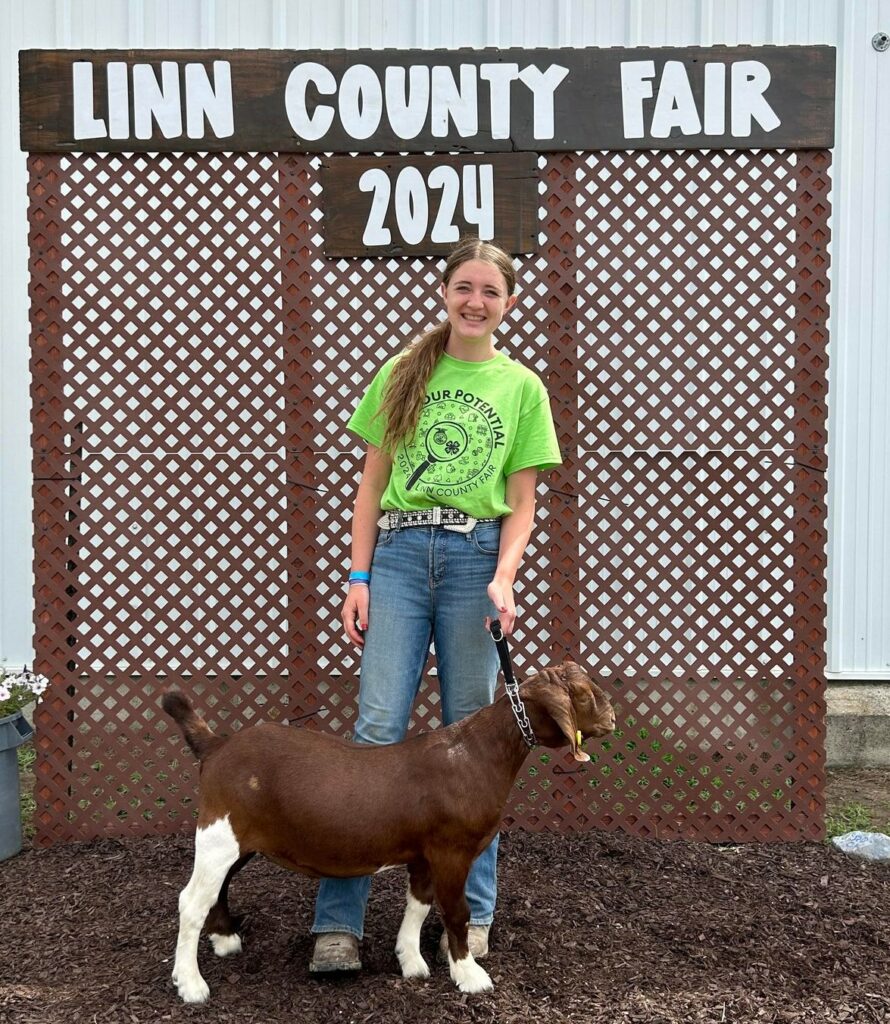

This year, Day Rettig Martin, P.C. purchased a market lamb shown by Becca Banes on behalf of Greely Sloan, a Market lamb from Taylor Kavanaugh, a market goat from Madie Boren, and a market pig from Lily Cook.

Beyond livestock, the County Fair showcases a diverse array of projects, demonstrating that 4-H is about much more than showing animals. Day Rettig Martin, P.C. values its connections with farmers, farm businesses, small and large enterprises, and their employees, reflecting their commitment to serving a broad clientele with deep roots in agriculture.

By fostering connections and supporting initiatives that promote agricultural education and community engagement, Day Rettig Martin, P.C. continues to play a vital role in shaping the future of agriculture in Linn County and beyond.

Visit Our

Visit Our Contact Us

Contact Us