We are proud to announce that Joseph Day has been reelected President of the Iowa Comprehensive Health Insurance Association (HIPIOWA) for his seventh consecutive term. HIPIOWA plays a vital role in ensuring access to health insurance coverage for Iowans who are otherwise considered medically uninsurable. Joseph’s continued leadership reflects his long-standing commitment to public service and improving healthcare access across the state.

We are proud to announce that Joseph Day has been reelected President of the Iowa Comprehensive Health Insurance Association (HIPIOWA) for his seventh consecutive term. HIPIOWA plays a vital role in ensuring access to health insurance coverage for Iowans who are otherwise considered medically uninsurable. Joseph’s continued leadership reflects his long-standing commitment to public service and improving healthcare access across the state.

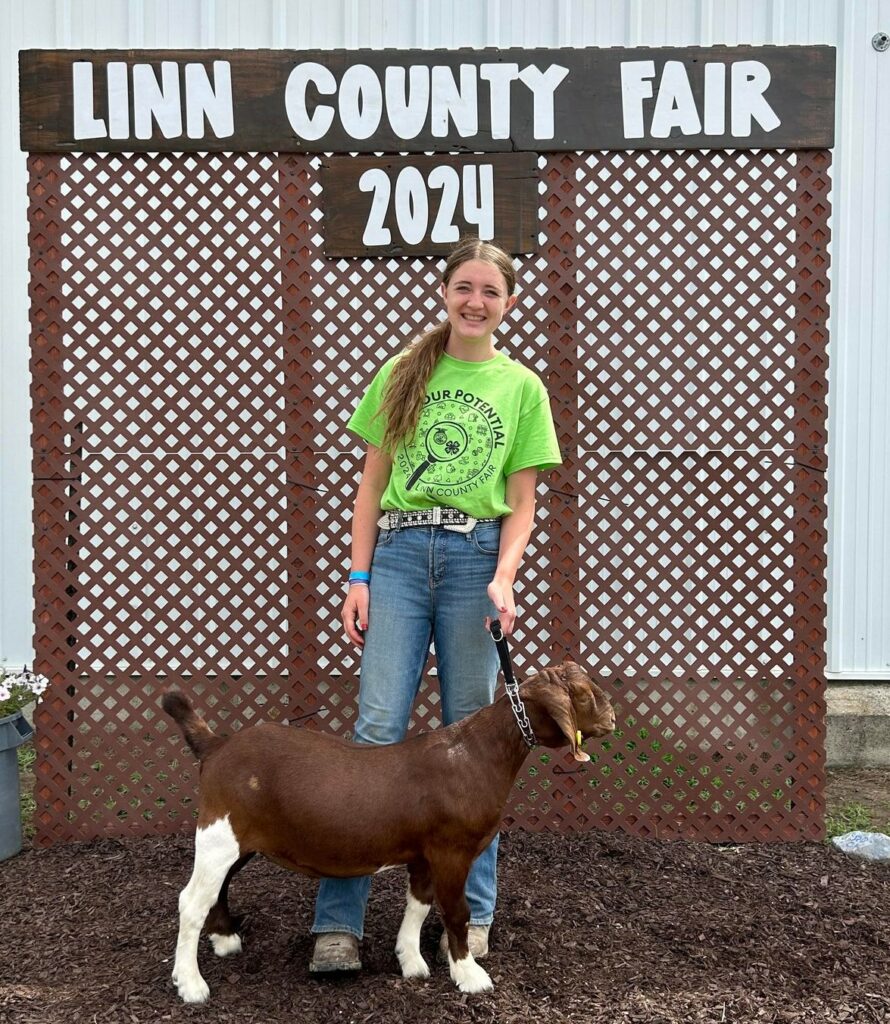

Linn County Fair 4-H & FFA Auction 2024

Day Rettig Martin, P.C. is proud to continue its tradition of supporting the next generation of agricultural leaders through active participation in the Linn County Fair Youth Livestock Auction. Growing up on a farm himself and having been a member of 4-H and FFA, Attorney Ron Martin understands firsthand the importance of youth programs in promoting skills and values.

This year, Day Rettig Martin, P.C. purchased a market lamb shown by Becca Banes on behalf of Greely Sloan, a Market lamb from Taylor Kavanaugh, a market goat from Madie Boren, and a market pig from Lily Cook.

Beyond livestock, the County Fair showcases a diverse array of projects, demonstrating that 4-H is about much more than showing animals. Day Rettig Martin, P.C. values its connections with farmers, farm businesses, small and large enterprises, and their employees, reflecting their commitment to serving a broad clientele with deep roots in agriculture.

By fostering connections and supporting initiatives that promote agricultural education and community engagement, Day Rettig Martin, P.C. continues to play a vital role in shaping the future of agriculture in Linn County and beyond.

Linn County Fair 4-H & FFA Auction 2023

Day Rettig Martin, P.C. is pleased to continue its support of the next generation of agriculturalists by participating in the Linn County Fair Livestock Auction. Having grown up on a farm and been a member of 4-H and FFA himself, Attorney Ron Martin understands the value of youth programs. This year Day Rettig Martin, P.C. purchased a market lamb from Jack Arnold (shown here) and a market pig from another 4-H youth.

The people of Linn County and beyond should be aware that Fair participants presented a variety of projects other than livestock for judging at the County Fair. As they say “4-H, it isn’t all cows and cooking.” Day Rettig Martin, P.C. is proud to include farmers, farm businesses, small and large businesses, and employees in its clientele.

DRM Murder Mystery Night

The DRM 1930’s murder mystery gang.

Child Support Guidelines Have Been Revised

The Iowa Supreme Court has issued an Order revising the Child Support Guidelines. Those revisions take effect on January 1, 2022 and apply to cases pending on that date and thereafter. They also apply to modification of child support orders.

The purpose of the Guidelines is to provide for the best interests of the children by recognizing the duty of both parents to provide adequate support for their children in proportion to their respective incomes. There can be a low-income adjustment for low-income obligated non-custodial parents with the objective of striking a balance between adequately supporting the obligated parent’s children and allowing the obligated parent to live at least at a subsistence level.

There is a rebuttable presumption that the amount of child support calculated under the Guidelines is the correct amount of child support to be awarded; however, that amount may be adjusted upward or downward to provide for the needs of the children or to do justice between the parties under the circumstances of the case pursuant to Rule 9.11. The court may, if appropriate, impute income to a party under Rule 9.11. Any variance must be supported in a written finding by the Court. Child care expenses can play a role in determining a variance but are considered independent of any amount computed by the use of the Guidelines or any other grounds for a variance.

Spousal support, whether paid in the present case or in a prior case, is considered when determining how “gross monthly income” is determined based upon whether the spousal support is subject to income taxation; however, “reimbursement spousal support” will not be added to a payee’s income or deducted from a payor’s income when determining “gross monthly income”.

“Uncovered medical expenses” will be shared by the parties in proportion to their respective net incomes in joint physical care cases. In all other cases the custodial parent is to pay the first $250 per calendar year per child up to a maximum of $800 per calendar year for all children, thereafter the parties pay in proportion to their respective net incomes.

There are still credits given for extraordinary visitation care under Rule 9.9 depending upon the number of overnight visitations taken by the non-custodial parent.

The Guidelines dictate that all parties must file a child support guidelines worksheet prior to a support hearing or the establishment of a support order.

If you have a specific support issue, please contact our office.

Linn County Fair

Another hot and muggy Linn County Fair is in the books. Local 4-H and FFA members brought their projects for judging, and the public came to view the projects and attractions of the fair. As is the norm, the fair concluded with the livestock auction where this year the participants sold market hogs, sheep, and cattle. Potential buyers began registering at 8:00 am on Monday, June 28, at which time they were treated to a breakfast of doughnuts and other sweet breads. One new feature of the auction was reserving locker slots for the livestock purchased. Either the buyers needed to make arrangement with the locker/processor ahead of time to process the animal, or the seller could reserve a spot. Any animal not kept for processing would be sent to market. Attorney Ron Martin once again attended the Fair and the Livestock Auction. Having grown up on a farm and been a member of 4-H and FFA himself, Ron likes to support the young agriculturalists by participating in the auction. Below is a picture from two of the girls that Day Rettig Martin, P.C. bought livestock from at the auction.

Ron’s law practice includes agricultural and business debt restructuring and commercial matters. If you have any legal questions about your farming or business operation, feel free to call Day Rettig Martin, P.C.

Update on the American Rescue Plan Act

On March 11, President Biden signed the American Rescue Plan Act (ARPA), the government’s most recent $1.9 trillion coronavirus relief bill. According to information provided by the US Chamber of Commerce, there are many things in the new bill to assist struggling small businesses. In particular, the ARPA establishes what is known as the Restaurant Revitalization Fund (RRF) separate and apart from the existing Payroll Protection Program (PPP). This new RRF establishes a $28.6 billion grant program specifically for restaurants and bars. Owners with fewer than twenty locations and whose locations are not owned by the state or local government will be able to apply for RRF grants.

Unlike the PPP where applications are through certain, qualified financial institutions, the RRF program will be administered directly through the Small Business Administration (SBA). There is no official launch date for the RRF program, but restaurant owners interested in applying for an RRF should prepare now by registering with the government using the System of Award Management (SAM) website. SAM registration is required so the government has the necessary information to process RRF applications. Entities not already registered with SAM should:

- Create a gov user account.

- Sign up for a DUNS number which typically takes one to two days to process.

- Using your login.gov account, DUNS number and basic business information you can then register for a SAM account. A SAM account request may take up to two weeks to process.

In addition to SAM account registration, interested restaurant/bar businesses should also prepare financial statements clearly showing a gross revenue loss during 2020 as compared to 2019. You may need assistance from an accountant in preparing this documentation.

Taking these steps now will allow you to take advantage of the RRF program as soon as the application period is announced. Government officials warn that funds for this program may go quickly.

The ARPA also extended the Employee Retention Tax Credit (ERTC) for an additional six months until the end of 2021. The ERTC provides a credit of up to $7,000 per employee per quarter for those small businesses still suffering economic hardships related to the pandemic. Again, in order to qualify for the ERTC, employers must show either:

- A suspension of operations due to governmental orders; or

- A 20% reduction in gross receipts during 2020 over the same calendar quarter in 2019.

Consult your tax advisor about taking advantage of this program.

Finally, on March 17, 2021, the House of Representatives voted to extend the deadline for new PPP applications from the current deadline of March 31 until May 31. This measure now goes to the Senate for approval. Majority Leader Chuck Schumer, D-N.Y. has indicated that Democrats in the Senate want to see this measure approved quickly. A companion to the House Bill extending the PPP deadline was introduced by a bipartisan group of senators including U.S. Senate Committee on Small Business & Entrepreneurship Chair Ben Cardin, D-Md.; Sen. Susan Collins, R-Maine; and Sen. Jeanne Shaheen, D-N.H.

If you have questions about these programs, contact attorney Erica Yoder.

Most Recent Changes and Updates to the Government’s Payroll Protection Program

On Wednesday, February 24, the Biden administration announced major changes to the Payroll Protection Program (“PPP”). PPP provides forgivable loans to businesses adversely impacted by the COVID-19 pandemic. The changes announced on Wednesday are designed to benefit and get payroll assistance funds into the hands of small businesses. For a two-week period beginning February 25, 2021 and running through March 10, 2021, the Small Business Administration (“SBA”) will be accepting PPP applications only from small businesses – those businesses with fewer than 20 employees. The SBA is encouraging approved PPP lenders to reach out specifically to minority- and women-owned business, as well as sole proprietorships and independent contractors.

The changes announced on Wednesday also affect how the loan amounts are calculated. Instead of net income, the available loan amounts will be calculated using the applicant’s gross income as shown on Line 7 of Form 1040, Schedule C instead. Applicants are still required to show a twenty-five percent (25%) loss in revenue during 2020 compared to the same calendar quarter during 2019 in order to qualify. For PPP loans of less than $150,000, applicants are not required to provide proof of lost revenue at the time of application. However, proof of lost revenue will be required at the time of loan forgiveness. Applicants for loans of less than $150,000 will also benefit from a simpler, one page loan forgiveness form.

Applicants who were previously awarded PPP funds can apply for a “second draw” loan so as long as they meet the eligibility requirements noted above. According to published reports, there is approximately $143 billion in PPP funding still available.

If your current lender or financial institution does not offer PPP loans, the SBA has a website that matches applicants with approved lenders: https://www.sba.gov/funding-programs/loans/lender-match. More details about the Payroll Protection Program can be found on the SBA’s website: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program.

There are other programs that might be of assistance to small businesses during these unprecedented economic times such as:

- Economic Injury Disaster Loans: https://www.sba.gov/funding-programs/disaster-assistance/economic-injury-disaster-loans

- Employee Retention Tax Credit: https://www.irs.gov/coronavirus/employee-retention-credit

If you have any questions regarding how this program will effect you or your business, please contact Attorney Erica Yoder

Welcome Attorney Erica Yoder

Day Rettig Martin, P.C. welcomes Erica L. Yoder as an Associate Attorney with the firm.

Erica spent more than 14 years as in-house counsel for a large, publicly traded insurance company and 2 ½ years as in-house counsel for a holding company specializing in government contracts and turn around management before opening her own firm in 2017. She brings with her a great deal of experience within the business world. She has a BA degree from Central College, in Pella, Iowa, an MA from Purdue University, and received her JD from the University of Iowa. Growing up active in 4-H and living on a farm in rural Iowa County, Iowa, Erica brings an awareness of farm issues and a strong desire to assist rural clients. Her practice includes business formation and transactions, regulatory compliance, debt/creditor matters, bankruptcy, and estate planning.

Linn County Fair 4-H Online Auction

Due to the novel coronavirus and it ability to rapidly spread, many normal summer events were canceled this year. The Linn County Fair was one of those events. For the first time since it has been held at the Central City fairgrounds, there was no Linn County Fair. However, there were still 4-H and FFA members who raised their fair projects.

The 4-H/FFA youth continued to learn and apply their knowledge and efforts to gain experience with their projects and were able to “market” their projects with the help of the Linn County Fair Board. A special thanks to Hoge Auctioneering LLC for conducting an “online” auction for the youth. Interested persons were able to view fair projects and contribute to the members by bidding. Day Rettig Martin, P.C. was happy and proud to continue its support of the fair participants and was successful in winning the bids on four entries.

Day Rettig Martin, P.C. has added ribbons from four local 4-H members to its growing collection. As Covid-19 cases in Iowa continue to rise, we are glad to do our part to help our Linn County Community. We are confident that through the efforts of the Linn County Fair Board, the Iowa Extension Service, the youth participants, and caring members of the community, the Linn County Fair will be back next year better than ever.

Visit Our

Visit Our Contact Us

Contact Us